Operating Through an Umbrella Company: A Contractor’s Guide

Thinking about working through an umbrella company but unsure what it really involves? You’re not alone. Umbrella companies provide an easy way for contractors, freelancers, and temp workers in the UK to get paid. However, they have special factors to think about regarding pay, tax, and control.

If you’re new to contracting or exploring options after IR35 changes, it’s key to understand how umbrella companies work. This guide covers all you need to know. You’ll learn how the system works, its tax impacts, the pros and cons, and when it may suit you best.

By the end, you’ll be armed with the clarity and confidence to decide whether an umbrella route suits your contracting career.

What Is an Umbrella Company?

An umbrella company employs contractors on short-term jobs, often through a recruitment agency. It provides a way for contractors to get paid without setting up their own limited company.

Here’s how it works:

- You sign a contract with the umbrella company, not the client directly.

- The umbrella signs a separate contract with the agency or end client.

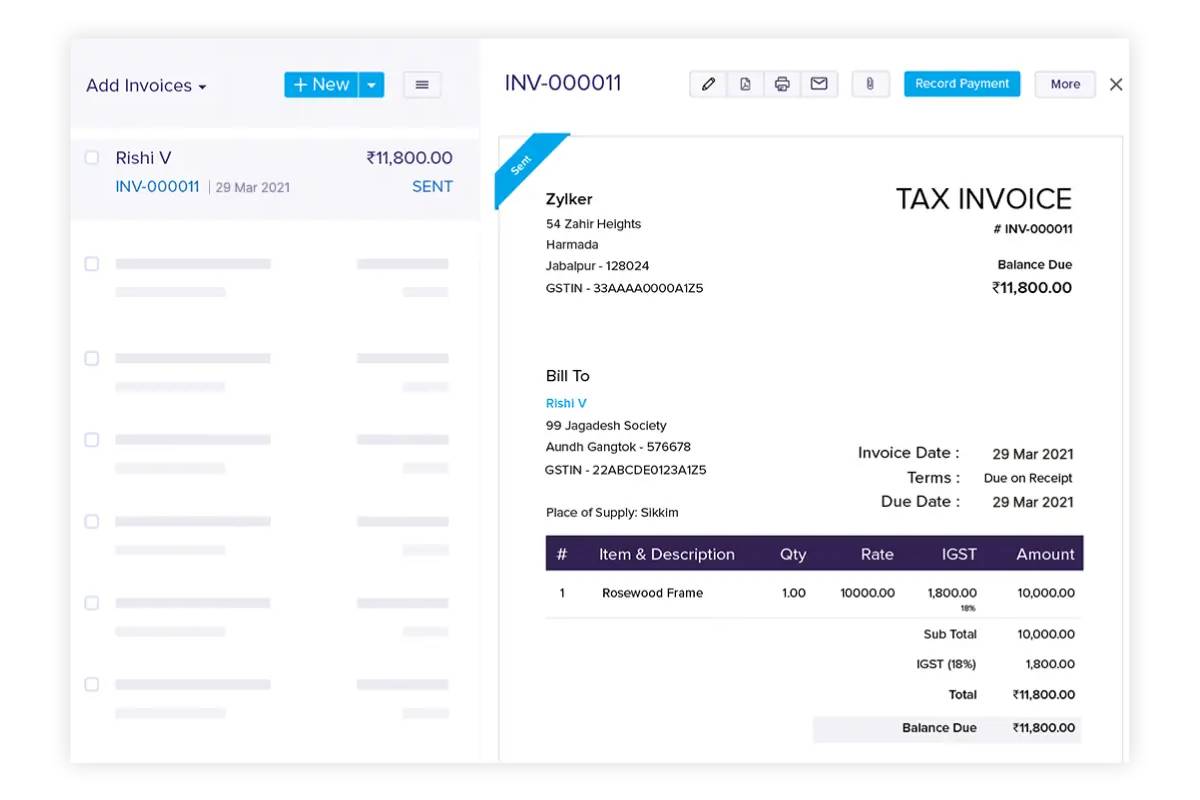

- You submit your timesheets, the umbrella company invoices the agency, and you get paid as a PAYE employee.

This model is common in fields like IT, engineering, teaching, and healthcare. It fits anywhere skilled labour is needed for a short time.

Why Do Contractors Use Umbrella Companies?

Freelancers have many reasons for choosing this path. This is especially true since the IR35 rules changed in 2021 for the private sector.

For many, umbrella companies offer a simpler, more hands-off experience. Others are left with little choice if the client mandates it.

Let’s break down some key motivations:

1. IR35 Compliance

Since the IR35 reforms, it’s become tougher to operate as a limited company on certain contracts. If a role is classed as “inside IR35”.

Working through an umbrella ensures:

- You’re taxed correctly

- You don’t face unexpected liabilities

- Your client isn’t at legal risk

2. Administrative Ease

No need to file Corporation Tax returns, maintain accounts, or chase invoices.

The umbrella handles:

- Tax and National Insurance deductions

- Payslips and holiday pay

- Pension contributions

- Insurance (like Employers’ Liability and Public Liability)

It’s a more “plug and play” experience than running your own company.

3. Access to Statutory Benefits

Umbrella employees are entitled to:

- Statutory Sick Pay (SSP)

- Maternity and paternity leave

- Workplace pension auto-enrolment

- Holiday pay (usually rolled into your rate or paid separately)

How Contractor Payroll Works Under an Umbrella

When you work through an umbrella, you’re officially on their payroll. But calculating pay can be confusing. This often leaves contractors wondering where their money went.

Let’s walk through an example:

Your contract rate: £400/day (the rate agreed with the agency) Worked: 5 days a week Gross invoice to agency: £2,000

From this amount, deductions include:

- Umbrella’s margin (typically £15–£30/week)

- Employer’s National Insurance (~13.8%)

- Apprenticeship Levy (0.5%)

- Holiday pay (accrued or advanced)

- Your PAYE income tax and employee National Insurance

After all these, your net take-home pay might be around 60–70% of the original contract value.

Key point:

Many contractors mistakenly expect to receive their day rate in full. But remember — your contract rate includes employer costs. It’s not the same as a gross salary.

Benefits of Using an Umbrella Company

Umbrella companies offer real benefits, especially for those who want easy contracting.

1. Simplicity and Convenience

There is no accounting software, tax deadlines, or annual returns. Your payslip shows everything clearly, and the umbrella handles compliance behind the scenes.

2. Employee Rights

Unlike limited company directors, you’re legally an employee.

That means:

- Holiday entitlement (28 days pro rata)

- Sick pay

- Pension contributions

- Employment protection

This can be reassuring during longer contracts or uncertain economic times.

3. Multi-Assignment Flexibility

You can handle various contracts for different agencies all in one place. There’s no need to switch setups or re-register.

4. IR35-Proof

Umbrella companies reduce the risk of IR35 since tax is managed at source through PAYE.

Drawbacks and Considerations

No solution is perfect. Umbrellas are handy, but they’re not for everyone. This is especially true for those who want to keep more of their income or have more control.

1. Lower Take-Home Pay

Umbrella companies usually provide lower net income than limited companies that are outside IR35.

You can’t:

- Claim as many expenses

- Split income through dividends

- Retain profits within your own company

For high earners, the difference can be significant.

2. Lack of Business Identity

You’re not running your own business. This can hurt your chances if you want to build a brand, pitch to clients, or grow your services later.

3. Inconsistent Holiday Pay Practices

Some umbrellas include holiday pay in your weekly rate. This can make it easy to overlook or spend without thinking. Others accrue it, which you must request when taking time off.

Top tip: Ask how your umbrella handles holiday pay from the outset.

4. Limited Control Over Finances

You rely on the umbrella’s calculations and processes. If they’re slow, inaccurate, or unhelpful, your pay could suffer.

Choosing a trusted provider is key. Pick one that is approved by the FCSA (Freelancer & Contractor Services Association) or Professional Passport.

What to Look for in an Umbrella Company

Not all umbrella firms are created equal.

Here’s a checklist to help you pick wisely:

- Transparent payslips: Clear breakdown of deductions

- FCSA accreditation: A Sign of ethical practice and compliance

- Fair margin: Weekly fees of £15–£30 are standard

- Efficient customer service: You’ll want quick, reliable help

- Insurance coverage: Public liability, employer’s liability, professional indemnity

- Follow HMRC rules: Avoid companies that promise loan schemes, pay advances, or tax breaks that sound too good to be true.

Red flag: If someone promises over 90% take-home pay, run! It’s likely a non-compliant scheme.

Umbrella vs Limited Company: Which Is Right for You?

This decision often comes down to:

- Your IR35 status

- The length and value of your contracts

- Your willingness to manage the admin

Choose an umbrella if:

- Your contract is inside IR35

- You prefer simplicity and statutory benefits

- You’re new to contracting or testing the waters

Stick with a limited company if:

- You’re outside IR35

- You want higher income retention

- You’re comfortable with admin and long-term freelancing

A Real-World Example: Emma’s Contracting Journey

Emma is a marketing consultant who started freelancing in 2021. At first, she worked through her own limited company and enjoyed the tax efficiency.

But after IR35 reforms, most of her clients — especially in the public sector — insisted on inside-IR35 contracts. She switched to an umbrella company to keep working with them.

At first, Emma was upset about the pay cut. But she later liked how easy payroll was, enjoyed sick pay, and avoided tax issues. She uses the umbrella for inside-IR35 jobs. For outside roles, she relies on her limited company. This approach gives her both flexibility and compliance.

How to Join an Umbrella Company

Getting started is relatively quick:

- Choose a provider — research, compare, and read reviews

- Sign an employment contract — this is usually straightforward

- Submit ID and banking info

- Send timesheets — usually weekly

- Get paid — minus deductions and margin

Ask for a take-home pay illustration beforehand so you know what to expect.

Conclusion: Is Operating Through an Umbrella Company Right for You?

Umbrella companies simplify contracting life. They handle your taxes, protect you under employment law, and reduce admin, making them a great fit for freelancers working inside IR35 or those new to the world of contracting.

But they’re not for everyone. If you’re earning at a higher level, outside IR35, and keen to retain more control over your finances, setting up a limited company might make more sense.

Key takeaways:

- Umbrella companies offer PAYE payroll for contractors

- You’re officially an employee with statutory rights

- Take-home pay is lower than through a limited company

- They’re ideal for IR35-compliant contracts and ease of use

Final advice: Weigh your options carefully. Speak to your recruitment agency, review contract terms, and use pay calculators to estimate your earnings. Above all, choose a compliant umbrella that follows the law.