Wie erlangt man ein günstiges Fertighaus

Einleitung

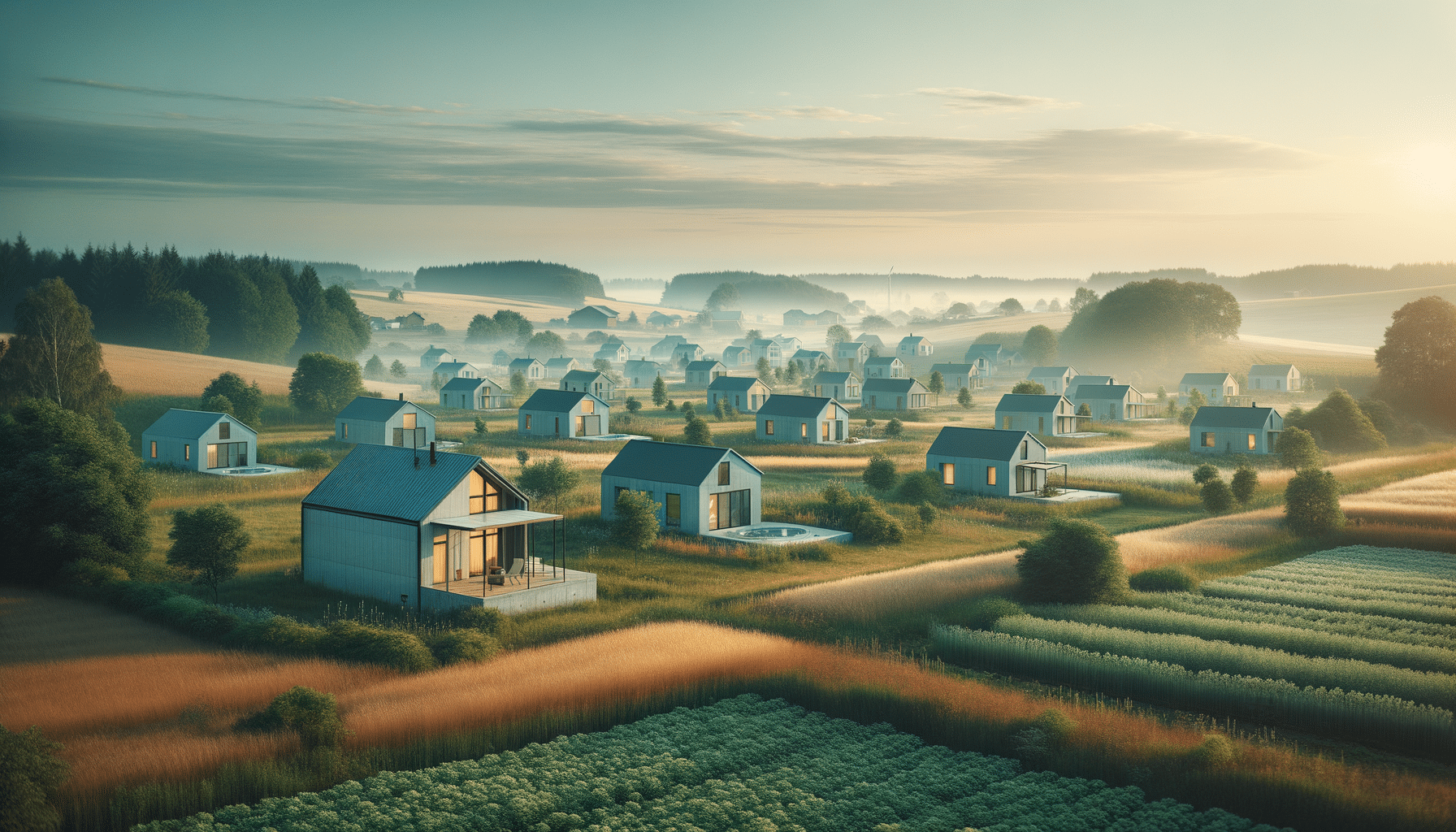

In Zeiten steigender Immobilienpreise und wachsender Nachfrage nach bezahlbarem Wohnraum suchen immer mehr Menschen nach kostengünstigen Alternativen zum klassischen Hausbau. Fertighäuser bieten hier eine attraktive Lösung, da sie nicht nur schnell errichtet werden können, sondern auch oftmals günstiger sind als herkömmliche Bauweisen. Doch wie findet man Wege zu günstigen Fertighäusern? Dieser Artikel beleuchtet verschiedene Aspekte, die bei der Planung und Umsetzung eines Fertighauses bedacht werden sollten, um Kosten zu sparen und trotzdem ein qualitativ hochwertiges Zuhause zu schaffen.

Günstige Haustypen & smarte Budgetplanung für Fertighäuser

Die Wahl des richtigen Haustyps ist entscheidend für das Budget. Es gibt verschiedene Haustypen, die sich preislich voneinander unterscheiden, wobei einfache Modelle wie Bungalows oder kleinere Einfamilienhäuser oft kostengünstiger sind als komplexere Strukturen. Bei der Budgetplanung sollte man auch die zukünftigen Kosten im Auge behalten, wie etwa Energieeffizienz und Instandhaltung.

Eine clevere Budgetplanung umfasst nicht nur die Anschaffungskosten, sondern auch die laufenden Kosten. Hierbei spielen Energieeffizienz und nachhaltige Bauweise eine große Rolle. Moderne Fertighäuser sind oft mit energieeffizienten Technologien ausgestattet, die langfristig Betriebskosten senken können.

- Modularität: Flexibilität im Design kann helfen, Kosten zu reduzieren.

- Nachhaltige Materialien: Investition in langlebige Materialien kann langfristig Kosten sparen.

- Eigenleistung: Wer handwerklich begabt ist, kann durch Eigenleistungen zusätzlich sparen.

Kostenfaktoren verstehen: Ausbaugrad, Region, Größe & Effizienz

Um die Kosten eines Fertighauses besser einschätzen zu können, ist es wichtig, die verschiedenen Kostenfaktoren zu verstehen. Der Ausbaugrad spielt dabei eine wesentliche Rolle. Je nach individuellen Wünschen und Bedürfnissen kann man zwischen verschiedenen Ausbaustufen wählen, die von schlüsselfertig bis hin zu Ausbauhäusern reichen.

Auch die Region, in der das Haus errichtet werden soll, beeinflusst die Kosten erheblich. In Ballungsgebieten sind die Grundstückspreise oft höher als in ländlichen Regionen. Zudem können regionale Bauvorschriften und die Verfügbarkeit von Handwerkern die Baukosten beeinflussen.

Die Größe des Hauses ist ein weiterer entscheidender Faktor. Größere Wohnflächen bedeuten in der Regel höhere Kosten, sowohl in der Bauphase als auch im Unterhalt. Daher sollte man genau abwägen, wie viel Platz wirklich benötigt wird.

Preiswerte Fertighaus-Modelle & regionale Preisvergleiche

Es gibt zahlreiche Fertighaus-Modelle, die preislich attraktiv sind. Kleine, kompakte Modelle oder solche mit einfacher Architektur sind oft günstiger zu haben. Ein Preisvergleich zwischen verschiedenen Anbietern kann ebenfalls helfen, das passende Modell zum besten Preis zu finden.

Regionale Unterschiede in den Preisen können erheblich sein. Ein Vergleich der Preise in verschiedenen Regionen kann sich lohnen, um ein Gefühl für den Markt zu bekommen. Oftmals sind Fertighäuser in strukturschwächeren Regionen günstiger zu erwerben, was sich positiv auf das Gesamtbudget auswirken kann.

Einige Anbieter bieten zudem spezielle Rabattaktionen oder Finanzierungsangebote, die den Erwerb eines Fertighauses erleichtern. Es lohnt sich, die Augen offen zu halten und verschiedene Angebote zu vergleichen.

Tipps, Förderung & Fazit: So wird der Traum vom Eigenheim bezahlbar

Um den Traum vom Eigenheim zu verwirklichen, gibt es verschiedene Tipps und Fördermöglichkeiten. Staatliche Förderungen, etwa durch zinsgünstige Kredite oder Zuschüsse für energieeffizientes Bauen, können die Finanzierung erheblich erleichtern.

Ein weiterer Tipp ist, frühzeitig mit der Planung zu beginnen und sich umfassend über verschiedene Anbieter und Modelle zu informieren. Je mehr man über den Markt und die Möglichkeiten weiß, desto besser kann man eine fundierte Entscheidung treffen.

Abschließend lässt sich sagen, dass Fertighäuser eine attraktive und kostengünstige Möglichkeit bieten, den Traum vom eigenen Haus zu verwirklichen. Mit den richtigen Informationen und einer sorgfältigen Planung wird der Traum vom Eigenheim bezahlbar.